All Categories

Featured

Table of Contents

Selecting to purchase the realty market, supplies, or other conventional sorts of properties is prudent. When determining whether you must purchase certified capitalist chances, you must balance the compromise you make between higher-reward prospective with the lack of reporting needs or governing openness. It should be claimed that private positionings entail higher levels of danger and can on a regular basis represent illiquid financial investments.

Specifically, nothing below must be analyzed to state or suggest that past outcomes are a sign of future efficiency neither should it be translated that FINRA, the SEC or any type of various other safeties regulator authorizes of any one of these safeties. In addition, when reviewing exclusive positionings from sponsors or business supplying them to recognized capitalists, they can give no service warranties shared or implied regarding accuracy, efficiency, or results acquired from any type of info supplied in their conversations or discussions.

The business ought to give details to you through a document called the Exclusive Positioning Memorandum (PPM) that offers a more detailed explanation of costs and threats related to taking part in the investment. Passions in these offers are only offered to individuals that certify as Accredited Investors under the Stocks Act, and a as defined in Area 2(a)( 51 )(A) under the Business Act or an eligible employee of the management business.

There will certainly not be any type of public market for the Passions.

Back in the 1990s and very early 2000s, hedge funds were known for their market-beating efficiencies. Typically, the supervisor of a financial investment fund will establish apart a part of their readily available possessions for a hedged wager.

Accredited Investor Rental Property Investments

For instance, a fund supervisor for an intermittent sector may devote a portion of the assets to supplies in a non-cyclical field to balance out the losses in situation the economic situation storage tanks. Some hedge fund managers utilize riskier strategies like making use of borrowed cash to acquire even more of an asset merely to increase their potential returns.

Similar to mutual funds, hedge funds are skillfully managed by career capitalists. Hedge funds can apply to various financial investments like shorts, alternatives, and by-products - Accredited Investor Property Investment Opportunities.

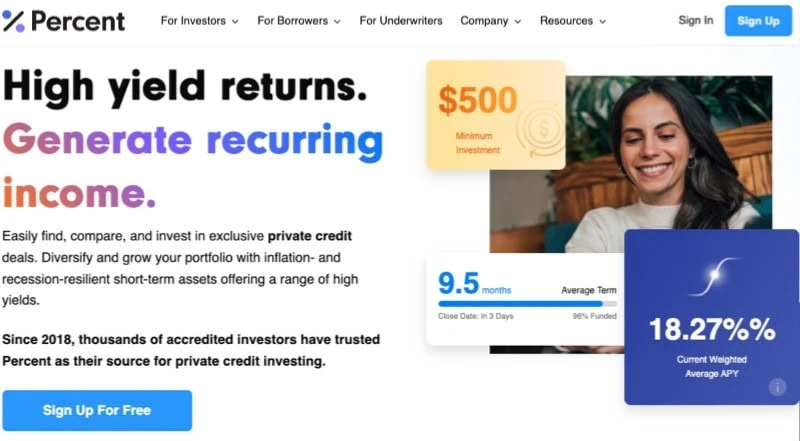

Why are Accredited Investor Real Estate Platforms opportunities important?

You might choose one whose financial investment philosophy lines up with your own. Do bear in mind that these hedge fund cash managers do not come affordable. Hedge funds commonly bill a fee of 1% to 2% of the assets, along with 20% of the revenues which functions as a "efficiency fee".

You can purchase a property and get awarded for holding onto it. Approved capitalists have a lot more possibilities than retail capitalists with high-yield financial investments and beyond.

What is the process for investing in Accredited Investor Real Estate Syndication?

You have to accomplish at least one of the complying with specifications to end up being a recognized investor: You must have more than $1 million total assets, omitting your main house. Business entities count as accredited capitalists if they have over $5 million in properties under monitoring. You need to have a yearly income that surpasses $200,000/ yr ($300,000/ yr for partners submitting with each other) You need to be a registered investment expert or broker.

Because of this, certified financiers have much more experience and money to spread throughout properties. Certified investors can pursue a more comprehensive series of properties, however more choices do not ensure higher returns. Many investors underperform the market, including recognized capitalists. Regardless of the greater standing, certified financiers can make considerable mistakes and do not have accessibility to expert info.

Crowdfunding gives recognized capitalists a easy duty. Property investing can assist replace your earnings or cause a quicker retired life. On top of that, capitalists can build equity through favorable cash flow and home admiration. Genuine estate homes need significant maintenance, and a great deal can go wrong if you do not have the right group.

What does Exclusive Real Estate Crowdfunding Platforms For Accredited Investors entail?

Real estate distributes pool money from recognized financiers to buy homes lined up with well established goals. Recognized financiers merge their cash with each other to fund acquisitions and property advancement.

Realty investment company should disperse 90% of their gross income to investors as returns. You can deal REITs on the stock market, making them extra fluid than the majority of investments. REITs enable financiers to diversify quickly across numerous residential property courses with really little funding. While REITs likewise turn you right into a passive capitalist, you get even more control over essential choices if you join a property distribute.

What happens if I don’t invest in Accredited Investor Real Estate Crowdfunding?

The owner can make a decision to apply the exchangeable option or to sell prior to the conversion takes place. Convertible bonds enable capitalists to acquire bonds that can end up being supplies in the future. Financiers will certainly benefit if the stock cost rises considering that exchangeable financial investments provide much more appealing entry factors. Nonetheless, if the supply tumbles, capitalists can opt against the conversion and safeguard their financial resources.

Latest Posts

Government Tax Foreclosure Sales

Tax Lien On Foreclosed Property

Invest In Tax Lien Certificates